Written by Rahul | September 8, 2025

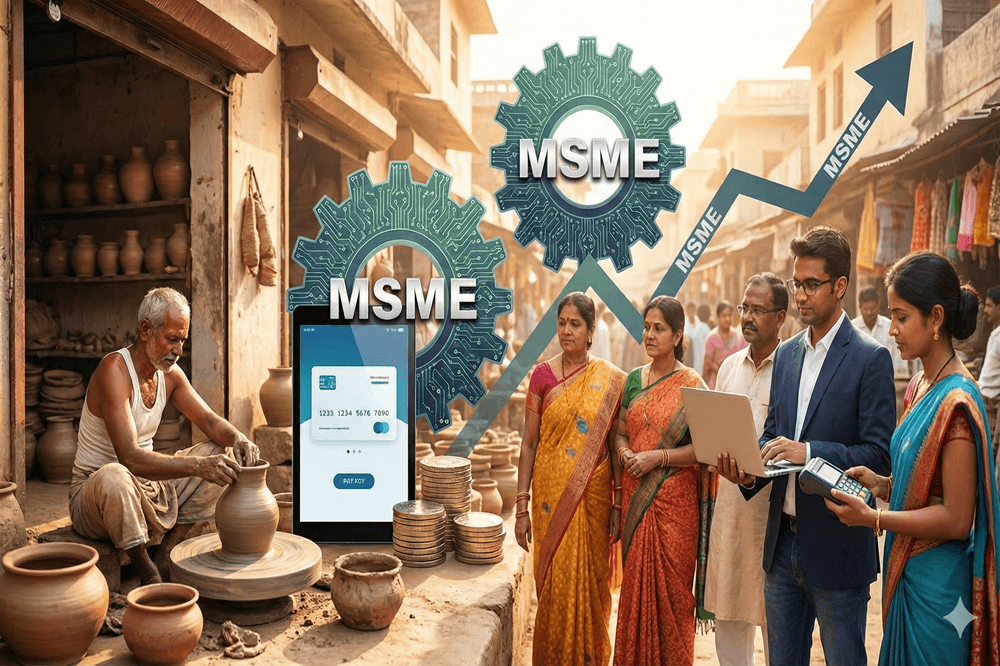

Ask ten small business owners in India how they registered their company, and you’ll hear ten different stories. One did it through a CA friend, another ran between government offices for weeks, and someone else swears by an online portal that kept crashing at midnight. The truth is: registering a business here isn’t rocket science, but it does test your patience.

Step 1. Pick Your Structure (Don’t Overthink It)

Most founders waste days reading jargon about Pvt Ltd vs LLP. Reality check:

- Freelancers and small traders? Sole proprietorship is enough.

- Want liability protection but not too much paperwork? LLP.

- Planning to raise money, bring in investors? Private Limited Company.

Everyone else just needs something simple. Don’t choose a Pvt Ltd just because it sounds fancy — compliance costs bite later.

Step 2. Lock Your Business Name

This part feels like naming a newborn. MCA (Ministry of Corporate Affairs) is strict — if your name even smells like an existing one, rejection is instant. Always keep 2–3 backups ready.

Step 3. Digital Signature (DSC)

Yes, you need a USB-like “digital pen” to sign forms online. Without it, nothing moves. It’s cheap, usually sorted by agencies.

Step 4. DIN, PAN, TAN – the Alphabet Soup

- DIN: Director Identification Number (mandatory for company directors).

- PAN: For taxes.

- TAN: Needed if you deduct TDS.

Good news — nowadays, most of these come bundled when you file through SPICe+ form online.

Step 5. File SPICe+ and Get Incorporated

This is the official “birth certificate” of your company. Once MCA approves it, you’re officially in the system.

Step 6. Bank Account

Don’t mix your chai stall money with household groceries. Open a business account. Banks like HDFC, ICICI, SBI — all have business products. Pick one that doesn’t drown you in hidden fees and connects well with accounting tools.

Step 7. GST (If You Qualify)

Turnover above ₹40 lakh? You need GST. Even if you don’t, many B2B clients won’t deal with you unless you have it.

Step 8. Other Licenses

Running a restaurant? FSSAI.

Import-export? IEC code.

Each business has its quirks.

The Rookie Mistakes Everyone Makes

- Going for the cheapest structure, then regretting it when investors show up.

- Ignoring GST until clients demand it.

- Choosing a company name without checking trademarks.

FAQs (Real Questions People Ask)

How long does it take? Around 7–10 working days if papers are clean. Longer if you miss a detail.

Cost? Sole proprietorship ≈ ₹5k. Pvt Ltd ≈ ₹10–15k.

Can I do it alone? Yes, but most hire a CA to save time.

Read more : Best Bank Accounts for Small Businesses in 2025

Disclaimer

This article is published by Newstic.in for news and informational purposes. While information is verified at the time of writing, details such as prices, dates, or specifications may change. Readers should confirm updates through official announcements or trusted sources before making decisions.