Written by Rahul | September 8, 2025

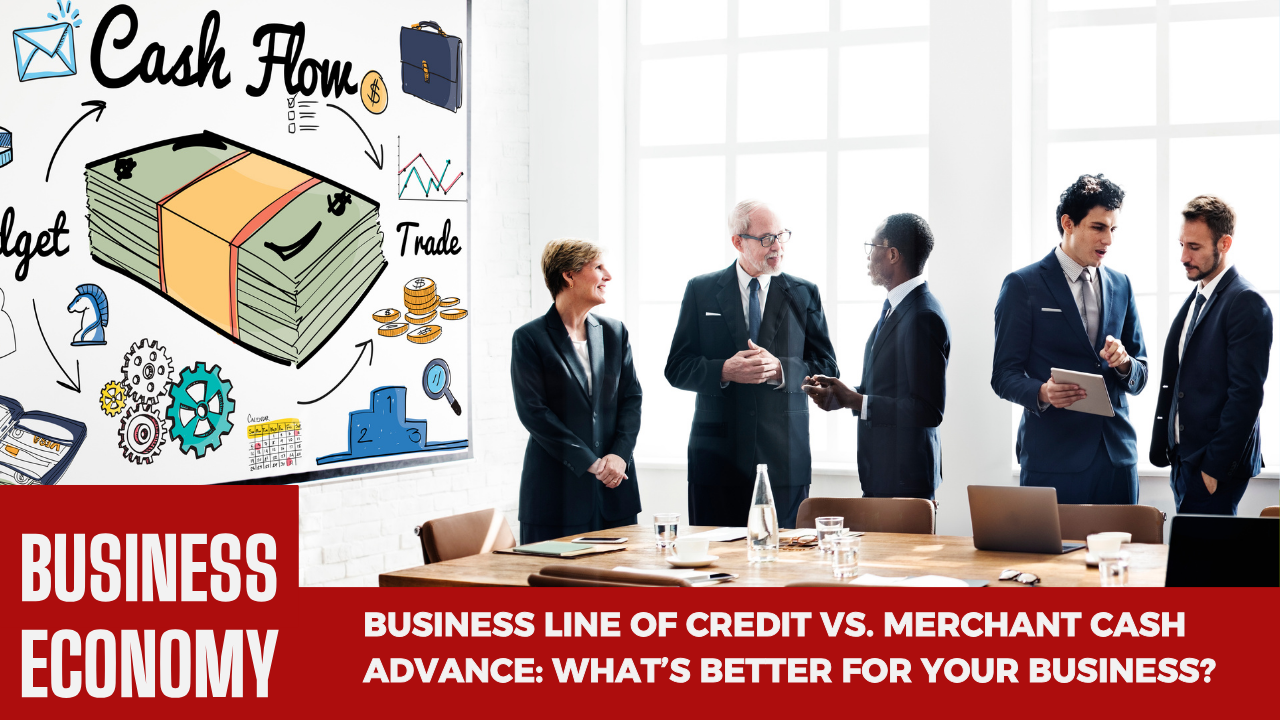

Every small business hits that wall: orders are coming in, clients are calling, but cash flow? Dry as summer ground. That’s when you start googling phrases like “quick funding for small business” and end up staring at two options: business line of credit and merchant cash advance (MCA). Both sound like lifelines. Both can also turn into a trap if you don’t understand them.

Let’s break it down like entrepreneurs actually talk about it — no banker jargon.

Business Line of Credit: The Flexible Friend

Think of this as a credit card for your business, but with more breathing room.

- The bank approves a fixed amount — say ₹10 lakh.

- You don’t have to use it all at once. You dip into it when needed, repay, and dip again.

- Interest? Only on what you use, not on the whole approved amount.

👉 Perfect for: covering short-term gaps, seasonal expenses, or stocking up inventory.

The catch: banks don’t hand this out easily. You need a decent credit history, paperwork, and often collateral.

Merchant Cash Advance (MCA): The Quick Fix

This is the “instant noodles” version of funding. Lenders give you money upfront — in return, they take a cut of your daily sales until you repay.

- Fast approvals (sometimes within days).

- Based on your credit card or online sales volume, not traditional credit scores.

- Repayments adjust automatically with your sales (good months = pay more, bad months = pay less).

👉 Perfect for: businesses with heavy card/UPI transactions — restaurants, retail stores, salons.

The catch: it’s expensive. High fees, high effective interest. Some entrepreneurs call it “legal loan sharking.”

Side-by-Side Reality Check

| Feature | Business Line of Credit | Merchant Cash Advance |

|---|---|---|

| Speed of Approval | Slow (banks take weeks) | Fast (days, sometimes hours) |

| Interest/Cost | Low (standard loan rates) | High (effective 30–60% annually) |

| Flexibility | Use only what you need | Fixed % cut from sales daily |

| Best For | Established businesses, steady flow | Retail/online sellers needing cash now |

Real Stories from the Ground

- A boutique in Delhi used an MCA to survive lockdown — money came in fast, but the daily deductions nearly strangled cash flow when sales dipped.

- A Bengaluru startup secured a line of credit and treated it like oxygen. They only tapped into it during crunch months, keeping costs under control.

Which One Should You Pick?

- If you have time and documents in order, go for a line of credit. Cheaper, safer, scalable.

- If you need money yesterday and most of your sales are digital, MCA is an option — but treat it as short-term only.

FAQs

Q. Can I have both?

Yes, many businesses do. LOC for stability, MCA for emergencies.

Q. Why are MCAs considered risky?

Because of sky-high costs. If sales dip, you may drown in repayments.

Q. Do Indian banks offer MCA?

In India, MCA-like products are mostly offered by fintech companies, not traditional banks.

Read more blogs:LLC vs. S Corp vs. Sole Proprietorship: Which One Fits Your Hustle?

Disclaimer

This article is published by Newstic.in for news and informational purposes. While information is verified at the time of writing, details such as prices, dates, or specifications may change. Readers should confirm updates through official announcements or trusted sources before making decisions.