Written by Rahul | September 8, 2025

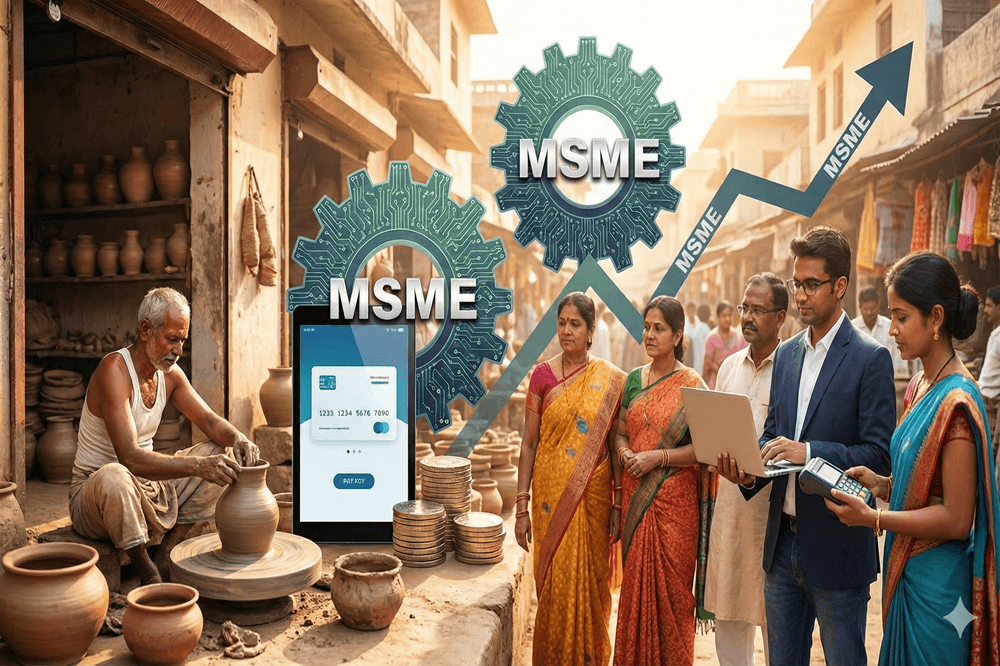

Every small business owner has the same nightmare story — running their company’s money through a personal savings account and watching the mess unfold. Taxes become a puzzle, payments look shady, and sooner or later, a client asks: “Can I get your business account details?” That’s when reality kicks in. A proper business bank account isn’t just about compliance; it’s about credibility.

But with every bank flashing ads about “best for entrepreneurs,” which one really works in 2025?

Why a Business Account Is Non-Negotiable

- Separation of funds: No mixing rent money with client payments.

- Tax benefits: Simplifies GST and income tax filings.

- Professional image: Clients trust invoices that carry a business account.

- Credit access: Most banks won’t offer a business line of credit unless you have a track record through their account.

What Features Actually Matter

Forget the marketing brochures — small businesses really need:

- Low minimum balance (startups can’t park lakhs just to keep an account alive).

- Digital-first services (UPI, netbanking, app integration with tools like QuickBooks Self-Employed).

- Easy overdraft/credit access.

- Merchant services (POS machines, online payment gateway).

Best Banks in India for Small Businesses (2025 Snapshot)

- HDFC Bank SmartUp: Tailored for startups. Comes with low balance requirements and connects well with accounting software.

- ICICI iStartup Account: Offers bundled services like GST registration and free debit cards.

- SBI Business Account: The old warhorse. Great reach, especially if you’re outside metro cities. Digital experience still improving.

- Kotak Neo for Business: Popular with freelancers and online sellers. No-frills, digital-first.

- Axis Bank Biz Account: Strong on merchant services and POS machines.

EMPI wins big HDFC Bank Grant.

— EMPI Business School (@empi_BSchool) December 26, 2023

EMPI Institution’s, Atal Incubation Centre (Supported by AIM, NITI Aayog,Government of India) has been awarded the 6th Edition of the highly prestigious HDFC Bank Parivartan SmartUP Grants for the FY 2022-2023.

#HDFCBank #Incubationstartup #empi pic.twitter.com/JLlriTduuL

Hidden Charges You Should Watch For

Every bank loves fine print. Watch out for:

- NEFT/RTGS charges on high transactions.

- SMS alerts and “value-added” services you never asked for.

- Annual fees on debit/credit cards.

Pro Tips From Entrepreneurs

- Open accounts in at least two banks — one for daily ops, one as backup.

- If you plan to scale, pick a bank known for business funding and credit cards.

- Always negotiate. Banks are more flexible with charges than they admit.

Mistakes Small Business Owners Make

- Running everything through a personal account to “save paperwork.”

- Choosing a bank just because it’s close to home, ignoring digital services.

- Ignoring startup-friendly accounts and paying extra in hidden charges.

FAQs

Q. Can I use my savings account as a business account?

Technically yes, but it’s messy and frowned upon by tax authorities.

Q. Do I need documents to open a business account?

Yes — PAN, GST, incorporation certificate (for Pvt Ltd/LLP), or shop license (for proprietorship).

Q. Which bank is best for freelancers?

Kotak Neo and ICICI iStartup accounts are popular.

Read more blogs: How to Register a Business in India: Step-by-Step (The Real Way People Do It)

Disclaimer

This article is published by Newstic.in for news and informational purposes. While information is verified at the time of writing, details such as prices, dates, or specifications may change. Readers should confirm updates through official announcements or trusted sources before making decisions.